TL;DR

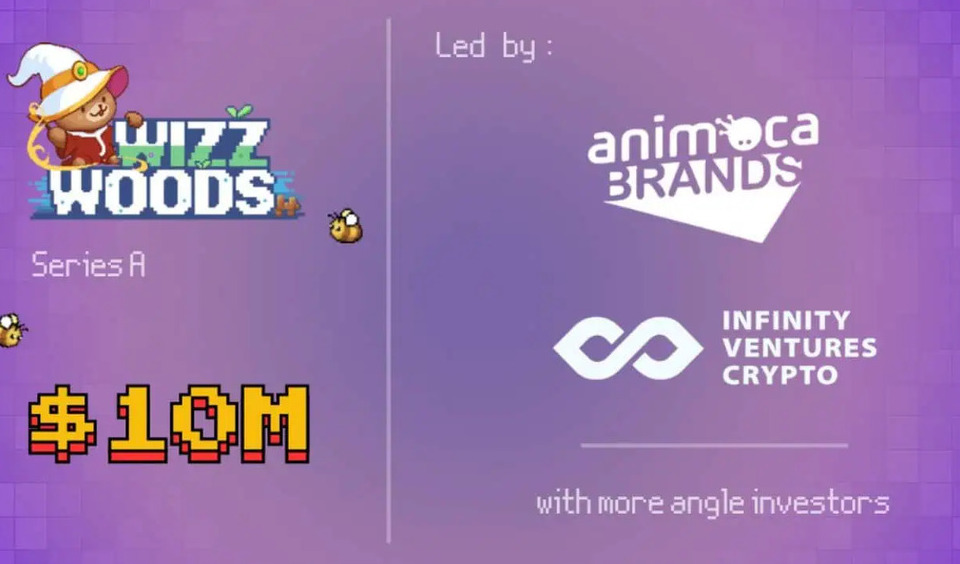

- Wizzwoods raised a $10 million Series A round.

- Funding will accelerate SocialFi and cross-chain integration.

- Animoca Brands and Infinity Ventures Crypto co-led the investment.

Wizzwoods has closed a $10 million Series A on November 19, 2025, co-led by Animoca Brands and Infinity Ventures Crypto (IVC), with participation from angel investors. According to the company, the financing will accelerate the integration of SocialFi and cross-chain capabilities in its game, a key bet for scaling and the interoperability of digital assets. The announcement arrives in a more restrictive crypto venture environment, underscoring the project’s focus on technical execution and compliance.

Big moves happening at Wizzwoods!

With a $10M investment from Animocabrands, IVC and more angels investors, we’re more equipped than ever to bring you the epic gaming experiences you’ve been waiting for.

This milestone will fast-track our development and help shape the future… pic.twitter.com/tVPVOyTy67

— Wizzwoods (@WizzwoodsGame) November 18, 2025

Round details and use of proceeds

The investment of 10.000.000 $ was formalized as a Series A on 19/11/2025 with Animoca Brands and IVC as co-leads, alongside angel investors, according to Wizzwoods. The studio describes its product as an idle farming game with a pixelated aesthetic and cross-chain functionality, and indicates that the capital will be directed mainly to incorporate advanced SocialFi features and strengthen interoperability between chains.

SocialFi combines social and economic elements so that interaction generates monetizable value, while cross-chain refers to transferring assets and data between blockchains without centralized intermediaries.

The team expects these improvements to increase retention and convert users into active economic participants within the Wizzwoods ecosystem.

Market context and implications for investors and compliance

Animoca Brands participates in the round with a track record oriented toward digital ownership, combining capital and market signaling that validate the SocialFi and interoperability thesis applied to gaming. The firm, based in Hong Kong and co-founded by Yat Siu and David Kim, reports a portfolio of over 628 companies and an approximate valuation of 5,9 B$ according to its releases, and has led previous bets in projects such as KapKap, Mocaverse and stakes in The Sandbox, Decentraland and other relevant platforms. IVC appears as a co-lead with a similar strategic motivation, although with less public exposure in comparison.

The injection of 10 M$ represents financial and strategic backing for the development of SocialFi and cross-chain functions in Wizzwoods. It implies a test of technical execution and compliance in a more cautious capital market, with the next verified milestone being the progressive deployment of SocialFi integrations and cross-chain interoperability, marked by product updates and launch dates that the company must publish.